2026 Fee Subsidy Form

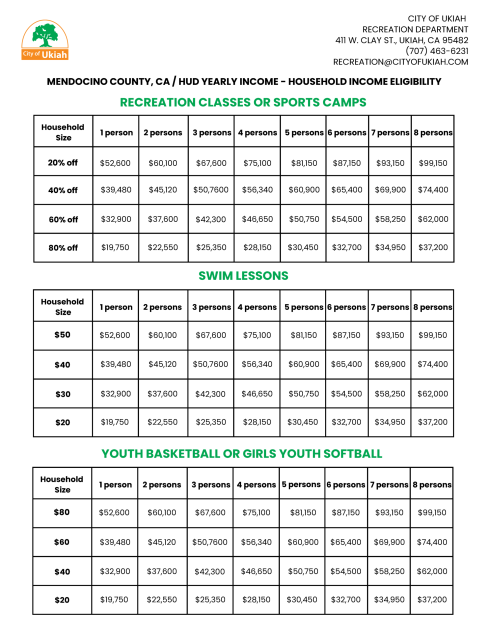

Assistance is open for City of Ukiah youth recreation classes and programs. Low-income families with residents under 18 years old in Ukiah and surrounding areas may qualify for partial fee subsidies based on household income and available funding. Eligible participants may receive up to 80% subsidy per child and the limit per family is $500.

Funding is limited, and priority will be given to families with the greatest financial need.

Scholarship Eligibility

To qualify for a scholarship, applicants must meet both of the following two criteria:

- Reside in Ukiah or surrounding areas, parent(s) works in Ukiah or participant attends a school in the Ukiah Unified School District

- Either live in a household that participates in one of the following government safety net programs (free and reduced school lunch; CalFresh (SNAP); Women, Infant Children (WIC); Medi-Cal; foster care; or child welfare system) OR their household income must be equal or less than 60% of the area median income, as determined by the following CDBG Income Limits.

HOW TO APPLY

PROGRAMS ELIGIBILE FOR ASSISTANCE

City of Ukiah Recreation Classes, Youth Basketball,

Girls Youth Softball, & Swim Lessons at the Ukiah Municipal Pools

The City of Ukiah Recreation Department will review all applications received. Those eligible for fee subsidies must pay their share of the fees at least 1 week before the start of each class. If applicants do not pay within 1 week before the start of each class, they may lose their spot and subsidy.

Ineligible applicants will be asked to come into our office and pay their class fees in full within 48 hours after being notified in order to stay registered in their class or program choices.

Please complete the applications above and provide the documents below:

- Copy of a Valid Driver’s License or Identification Card

- Proof of Residency in Ukiah, Talmage, Calpella, Hopland, or Redwood Valley or participant attends a Ukiah School District School

Most recent copy of eligibility letter from State or Federal or County assistance program

Prior year’s tax return for each household member or joint tax return (preferred) or benefit statement

If unemployed, a copy of unemployment verification

Additional documents that shows financial need